How to Buy Real Estate with No Money

Dreaming of Owning a Home or Commercial Property?

Struggling with bad credit, low income, high debt, or even no income at all? Don’t worry — we have a solution that can help you secure the property of your dreams.

Introducing the Corporate Credit Wealth Program

We help individuals get funded — regardless of their financial situation — by leveraging corporate credit instead of personal credit. Even if your personal finances are holding you back, this program can move you forward.

How It Works:

- Form a Corporation or LLC

- Build Corporate Credit

- Access 0% Interest Funding for 6–18 months

- Get Up to $150,000 in Just 6 Months

- Use Funds for Real Estate or Business Investments

This strategy allows you to eliminate personal debt, improve your credit, and begin building long-term wealth — all without risking your own paycheck.

Example: Anna’s Path to Financial Freedom

Anna (California) had:

- $55,000 in personal debt

- A 550 credit score

- Maxed out debt-to-income (DTI) ratio

What she did:

- Created two LLCs

- Built corporate credit ($75,000 each = $150,000 total)

- Paid off her $55,000 personal debt using corporate credit

- Her personal credit score jumped to 760

- Qualified for another $150,000 in personal credit (Hybrid Credit Program)

- Now has over $205,000 in available personal credit

💡 Reminder: Corporate debt does not appear on your personal credit report — and you're not personally liable for it.

Anna Buys Her First Investment Property

Location: Clearlake, CA

- Property: 3-bed, 2-bath lakefront home on 12,600 sq ft lot

- Home Price: $499,000

- Down Payment: $0 (100% financed)

- Monthly Payment: $4,300

- Airbnb Income: $10,700/month

- Profit: $6,400/month

Now Anna is building wealth without dipping into her personal income — and you can too.

What’s Next?

Once you’ve mastered the system, you can:

✅ Buy more investment properties

✅ Purchase commercial real estate

✅ Acquire existing businesses

✅ Grow your assets — all using corporate credit

Ready to build wealth the smart way?

Let us help you turn debt into opportunity — and dreams into reality.

HOW TO EARN $550 Selling Spare Power Join FREE & reserve extension node. After launch, install our extension. Earn passive income from device. Anyone can earn from this! Refer other users to earn $25 recurring. Earn $5 recurring overrides from 12 levels. Earnings are paid in USDT to your wallet. Early adopters build bigger & earn more! Life changing money, refer everyone! Find Out More!

Fully automated, built to open and close trades on its own, 24/7. Unlike signals, which require your action, this trading bot independently manages trades in Forex, Stocks, Indexes, Futures, Metals, and other markets. With this approach, the bot helps grow your account with minimal effort on your part.

By strategically reducing the total amount you owe, the system can redirect up to two-thirds of the interest that would normally go to the bank back into your account. By the end of your mortgage, you can save tens and even hundreds of thousands of dollars on interest payments, empowering you to create wealth for yourself and your family. Strategy work with student loans, credit cards, personal loans, mortgage, any debts! Our debt elimination program can help to Convert your Debt to Wealth. Eliminate your mortgage and all your debt in as little as 5-7 years, without changing your current budget! Navigate Your Fastest Route to Debt Freedom Pay Up to 70% Less in Interest – No Lifestyle Changes

How to build business credit with a tradeline? Add airbnb dome tradeline to build business credit. Let this tradeline make money for you year round. Put dome on your property to generate rural tiny home income, short term rental, events setting. Build your business credit and support your growth plans Flexible monthly payment term options from 12 – 60 months Low “out-of-pocket” costs as little as 1st payment down

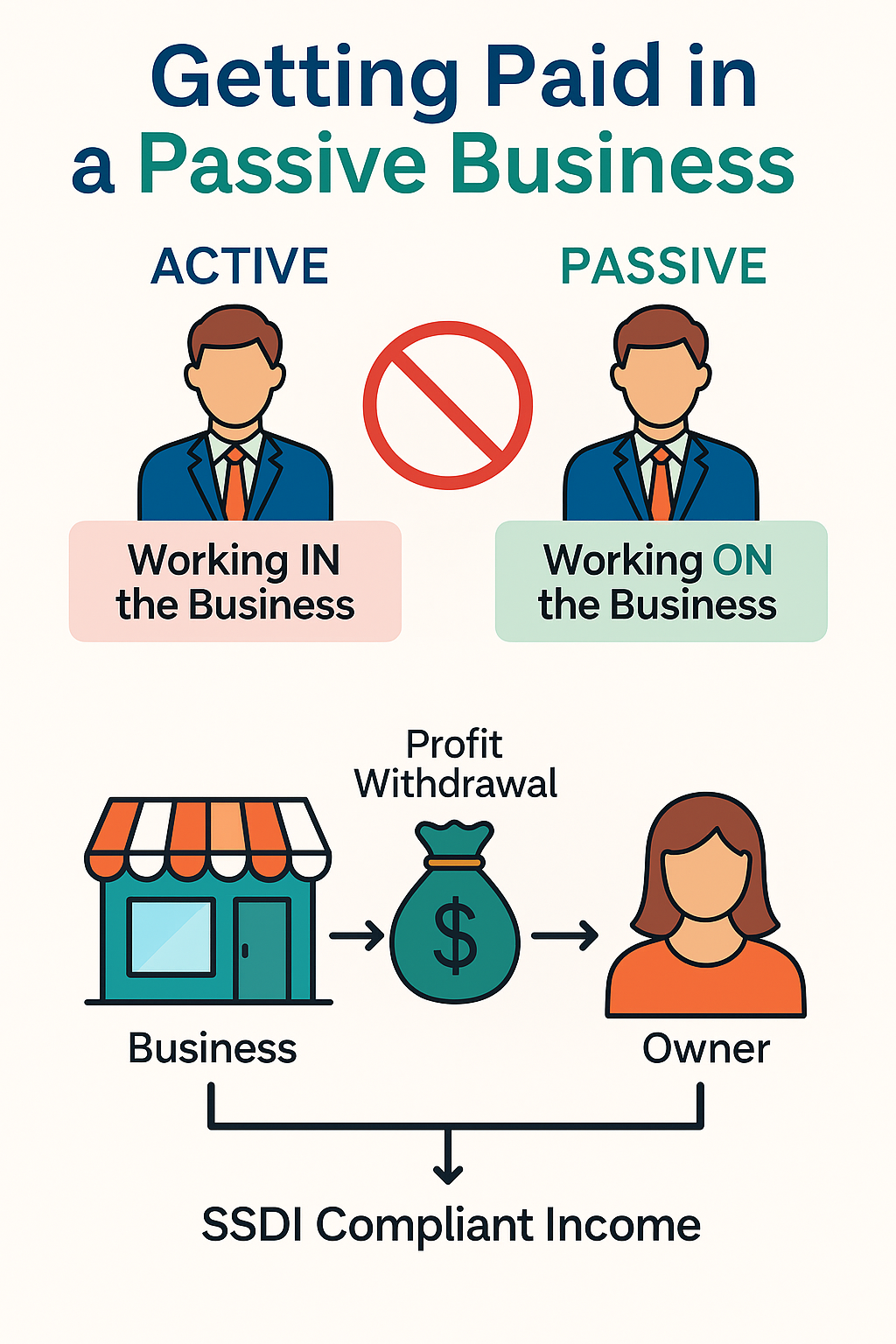

✅ Why Passive Income Is Not Counted as Earned Income for SSDI: SSDI rules define earned income as income from work you actively perform — like wages, salaries, or self-employment where your physical or mental effort is required. 🧾 What IS Earned Income (Counted by SSDI): Wages or salary from a job Bonuses and tips Net profit from self-employment (when you actively manage or work in the business) 💸 What Is NOT Earned Income (Not Counted by SSDI): Dividends and interest Rental income (if you're not actively managing) Royalties Affiliate commissions (if you set it and forget it) Passive dropshipping income (if automated) Digital product sales (if minimal involvement) This means that passive income like: Etsy digital downloads Affiliate links Dropshipping (with a team or automated) Online course sales Dividend investing …can grow your income without affecting your SSDI as long as you’re not actively working full-time in the business. ⚠️ Caveat: If your passive income becomes more like a job — requiring daily activity, managing employees, or heavy customer support — SSA may reclassify it as self-employment, especially if you report it on a Schedule C with a lot of time invested. So, the less effort you put in day-to-day, the more safely it's considered passive. 💡 Tip: Keep a log of hours worked and document how much effort you put in, especially if your income increases. You want proof that you’re not engaging in Substantial Gainful Activity (SGA). Passive income —like income from dropshipping stores, digital products, rental properties, or investments—is typically not counted as “earned income” under SSDI (Social Security Disability Insurance) rules. Here’s why: 🔍 Definition of Earned vs. Unearned Income: Earned income: Wages, salaries, tips, or net earnings from self-employment (including active work in a business). Unearned income: Includes interest, dividends, rental income (if not actively managed), and other passive sources. Why Passive Income Doesn’t Count (Usually): No active work involved—if you’re not managing inventory, customer service, or product creation daily, it’s not considered a job. Dropshipping & digital products can be structured as passive if outsourced (e.g., using automation or virtual assistants). SSDI allows passive income, but if SSA believes you're actively working in the business, they may count it as earned. Caution: If your name is on the business and you’re working it daily, SSA may view it as substantial gainful activity (SGA). Keep good records showing limited involvement (e.g., hired help, automation tools). Structuring your business to stay passive Writing a letter to document your business model for SSA Tracking tools to help show minimal involvement Here's how to structure your passive income so it doesn't affect your SSDI benefits—and how to track it safely. ✅ 1. What You Can Earn While on SSDI SSDI allows you to receive passive income without limit, but earned income is restricted. In 2025, the monthly earned income cap is: $1,550/month (non-blind) $2,590/month (blind) Passive income (like from dropshipping store or digital guides) is OK as long as: You're not actively working more than a few hours a week You're not running daily operations You’re not earning a salary or taking wages from the business 🧩 2. Structure Your Business as Passive Here’s how to protect your SSDI benefits while growing your income: 🔹 a) Automate Your Online Business Use print-on-demand, dropshipping suppliers (no inventory) Auto-fulfill orders with platforms like Shopify + DSers or Printful Hire a VA (virtual assistant) for support, marketing, and customer service 🔹 b) Separate Ownership from Operations Form an LLC or single-member LLC Do not pay yourself a salary or hourly wage Take profit as passive business income (Schedule C on taxes) 🔹 c) Avoid Work That Looks "Active" Don’t respond to customer emails personally Avoid managing day-to-day marketing (delegate or use automation) Don’t post or manage ads yourself long-term 📒 3. Track Your Activity and Income SSA may ask questions about your business. Be ready with: 📌 Activity Log Keep a log showing how little time you spend on the business Example: “Check-in 1x per week for 15 minutes.” Use a Google Sheet to document weekly activities. 📌 Income Report Log your monthly profit and source: Ad income, product sales, affiliate sales, etc. Mark what’s passive (e.g., auto-fulfilled orders) 🛡️ 4. Add This Note to SSA If Asked: “My business is automated and managed by hired help. I am not actively involved in daily operations, and I do not pay myself wages or a salary. My role is minimal and does not constitute substantial gainful activity.”

✔️ Nobody can become rich with salary. ✔️ Whoever is too afraid to invest, will die poor ✔️ The poor work to make money. ✔️ The rich make their money work .. ✔️ After finding work, you should find work for your money. ✔️ Your two combined remunerations will make your wealth. ✔️ Being too afraid to invest is like deciding not to sow because of a bad season that has caused huge losses ✔️ Be leaders and not followers. ✔️ Decide to be rich and not just rely on a likely job. ✔️ Great men are not born in greatness, they grow up. ✔️ If you do not run after what you want, you'll never get it. ✔️ If you do not ask, the answer will always be no. ✔️ If you do not take a step forward, you always stay in one place. ✔️ To succeed in your life, you must learn to never back down from obstacles and achieve the goal you have set for yourself. ✔️ A pessimist sees the difficulty in each opportunity, an optimist sees the opportunity in each difficulty

Cash is King. Credit is Power. Even without cash in hand, excellent credit opens doors to wealth-building opportunities most people only dream of. ✅ Get approved for home, auto, and personal loans at the lowest interest rates ✅ Earn passive income — up to $40,000 or more — just by leveraging your credit ✅ Launch and grow a business using your credit as capital With a high credit score, you save more, borrow smarter, and build faster . The illustration below shows how excellent credit doesn’t just give access — it saves thousands in interest, putting more money back in your pocket.