CORPORATE FUNDING

Business Loan Information

We fund under your corporation: LLC, S-Corp, C- Corp. Corporate Credit Building Products and Services are Available to Enhance your Company’s Credit Profile and Help your Company Obtain Funding Correctly.

Helping you grow your business is our priority.

Business loans are for everyone from start-up to long term. Some loans does not require a minimum credit score. Whatever your business need is, we can help!

35k to 50k in Immediate Funding, Plus an Additional 350K in the next 60 days.

Use these fund

- as a down payment to apply for a SBA loan up to $5,000,000

- to buy a business up to $350k

- as a down payment for your business

- to grow more funds

- etc

If you are a start-up, have not incorporated your business, don't worry; we can still help!

Timeframe: at least 45 days to get funded.

Fill in the form to get more information

Self-Employed

Gig-Worker Funding

Drivers, Contractors, Uber, Lyft, Shoppers, etc

REQUIREMENTS

- $3,000+ Monthly Bank Revenue

- 3+ Months In Business

No fees to apply, and this will not affect your credit score.

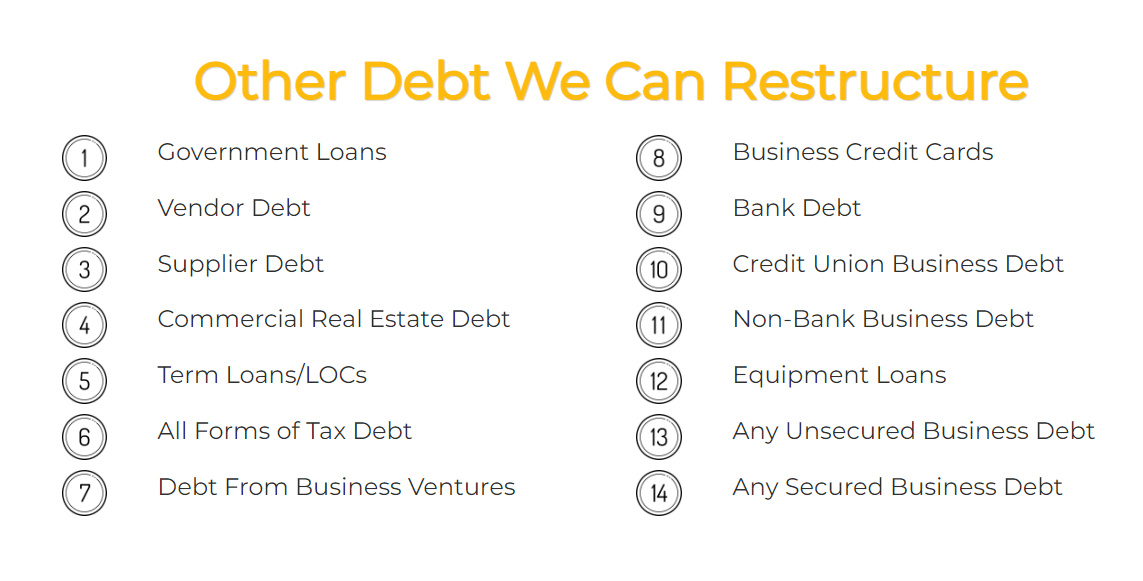

Merchant Cash Advance debt restructuring & settlement

Are you drowning in merchant cash advance (MCA) debt?

Work with the team that leads the industry in mca debt restructuring & settlement.

Let us help you restructure your business debt today.

- They want to pay their creditors but can’t afford the payments.

- They’ve already attempted negotiating on their own without any permanent results.

- They can’t get any more financing.

- Their cash flow is tight.

- They can’t focus on their business and debt solutions at the same time.

- They need better payment plans on their existing debt.

- They want to avoid business bankruptcy.

We need more MCA Consultants to the team. Earn $1,500 Per File.

Free Consultation Debt FREE

You can reasonably expect to see your payments drop an average of 40% - 75%*.

CUT COSTS FOR YOUR BUSINESS

REDUCE YOUR OVERHEAD COSTS AND SAVE YOUR TIME!

If you’re like most businesses, you could be overpaying lots of different ways. Maybe you are paying more than you should for basic services like Internet or phone. Or maybe you are not optimizing your energy consumption and rate. Or maybe your utility bills have errors, discrepancies and mistakes that you can correct and pay less. Regardless of WHY you are overpaying, the HOW to lower your bills is simple. Let us manage them for you!

Business Owners, turn your expenses into assets

We'll show you how to:

- Turn your bills, expenses into assets

- Spend the same amount of money more effectively.

- Pay off your debt in half the time that it currently takes.

- Control cash flow

- Lower the risk

- Reduce taxes now and in the future to save money

EVERYTHING without spending any additional dollars.

27

Current years to pay off debt

$650,880

Total Interest Paid

$2,135,900

Total Debt

$2,786,780

Real Debt

Look carefully at his Real Debt and total interest paid. Would you like to see these money go back to you?

Our business solution to Joe

27

Current Debt Plan Payoff Years

6.4

We help him Payoff in years

$270,008

Interest Saved

$312,000

Cashflow each Year

After paying off debt in 6 years, Joe have cashflow to grow his business, invest more, do anything he want.

Remember Joe is 50 year old. He will be 57 when his debt is paid off. His current plan without us make him debt free at age 77. Can you imagine yourself still stressful about money, no cashflow, still working in your 70s? The sooner you start a plan with us, the better!